Learn * Compare * Enroll in 3 easy steps

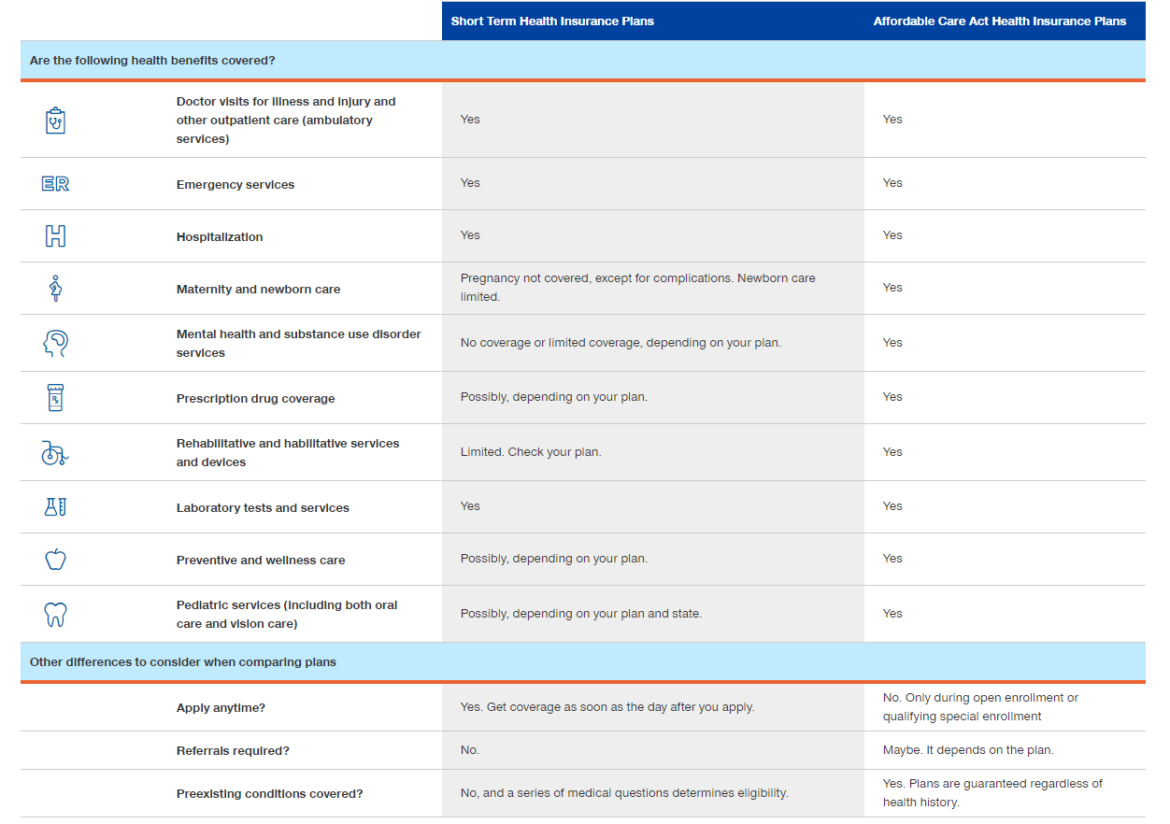

Short Term Medical Vs ACA

Buying health insurance for short terms

may be the right choice for you right

now, but it won’t be ACA coverage.

Other Health Coverage (OHC) refers

to private health insurance.

Services may include, Fixed Indemnity,

Short Term Medical Insurance,

Critical Illness Insurance,

Accident Insurance.

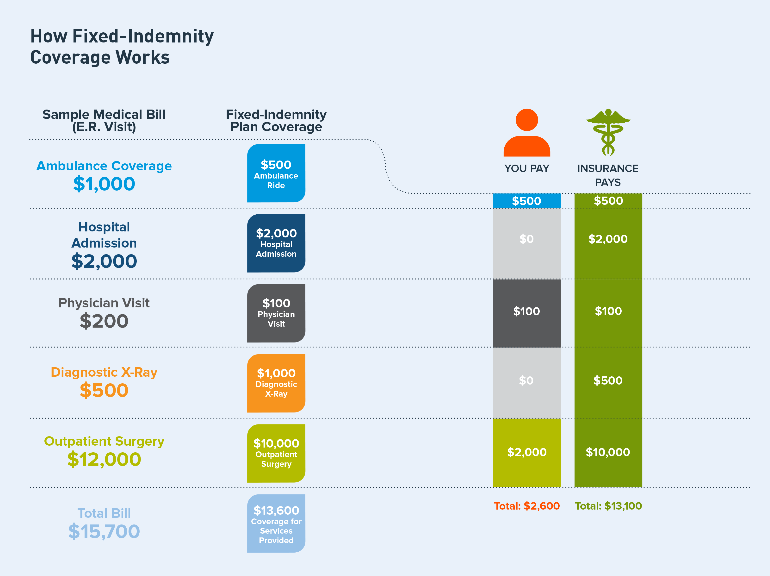

A fixed indemnity plan is one that pays a predetermined amount of money for any qualified medical services you receive. So, for example, if your plan specifies a $100 per day benefit for X-rays and you break your arm and have to get an X-ray, you are paid $100 from your plan.

Because the benefit is preset and paid out regardless of what the total bill for the qualified service might be, fixed indemnity insurance is sometimes called fixed benefit insurance or fee for service insurance.

Short Term health insurance, sometimes called Term health insurance or Temporary health insurance, is designed to help bridge gaps in your health care coverage during times of transition.

Critical Illness insurance, also known as Critical Care insurance or Critical Illness coverage, pays a lump sum cash benefit directly to the policyholder in the event of a qualifying serious illness.

Having a Critical Illness policy in place can help reduce the financial burden and lead to less stress during recovery.

Accident insurance, also known as supplemental accident insurance or personal accident insurance, can help with those unanticipated medical costs that come with an accidental injury.

Hospital Indemnity insurance, also called Hospitalization insurance or Hospital insurance, is a plan that pays you benefits when you are confined to a hospital, whether for planned or unplanned reasons, or for other medical services, depending on the policy.

Hospital and doctor fixed indemnity insurance, often called fee for service insurance or fixed benefit insurance, pays a set benefit after you receive specific covered medical services.

- You’re paid that benefit regardless of other coverage you have. You get cash that you can use to help offset expenses your health insurance might not cover.

- You can generally apply for these plans at any time.

- Most often you have to answer a series of medical questions to apply and qualify.

- Plans vary in what services they cover, and generally do not cover services resulting from preexisting health conditions.

Bottom line: Worried that high deductibles or other out-of-pocket costs from your health insurance plan will turn it into less affordable health insurance for you? A fixed indemnity plan might help.

Short term medical insurance is sometimes called term medical insurance or temporary medical insurance. That’s because it’s designed to provide health care coverage during a limited series of months where you don’t have other coverage.

- Designed to be your primary health insurance, but doesn’t offer the same benefits as ACA medical plans. Plans will vary in what they cover.

- Plans typically do not cover preexisting medical conditions.

- You have to answer a series of medical questions to determine if you are eligible.

- Short term medical insurance generally costs less than ACA coverage, but in some states you may be subject to a tax penalty for not having minimum essential coverage.

- You can apply at any time, all year round.

Bottom line: Have you lost or just rolled off some other coverage or do you need temporary medical insurance while you decide on a longer term solution? A short term health plan may be for you.

A major medical insurance plan will pay for all or a percentage of covered expenses after you meet certain deductibles, copays or out-of-pocket costs. However, a fixed indemnity plan is different. It pays you a certain predetermined amount for specified health care services.

- You don’t have to pay copays or out-of-pocket deductibles before you get benefits.

- You don’t have to worry about conflicts with other insurance coverage.

- You don’t have to stay in-network if you don’t want to.

If you have a qualified expense under your Hospital and Doctor fixed indemnity plan, you or the provider you designate get paid the amount specified in your plan for that service.1

Don’t be confused. This type of plan provides limited benefits. It pays a certain amount per covered medical service, often up to a certain calendar-year maximum.

It is not major medical insurance and does not provide the coverage mandated by the Affordable Care Act (ACA), often called Obamacare. It does not provide coverage for all the essential health benefits outlined in the ACA.

And unlike an ACA plan, it will most likely not provide coverage for expenses resulting from any preexisting medical conditions. Read your plan carefully to see what is and what isn’t covered. Simply put, a fixed indemnity plan isn’t meant to be your main health insurance.

While a Hospital and Doctor fixed indemnity plan has no network limitations, if you have a major medical plan, you may need to stay with certain networks and providers to get the most coverage out of that plan. Be sure to take that into consideration.

What You Need to Know About Short-Term Health Insurance

Healthcare is expensive. The Department of Health and Human Services is helping consumers by allowing short-term, limited-duration health plans to last up to one year, and gave consumers the option to renew these plans for up to 36 months

Short term medical insurance typically provides

some level of coverage for: preventive care, doctor

visits, urgent care, and emergency care. There may

also be coverage for prescriptions. Some plans also

offer cost savings for seeing in-network providers.

Unlike traditional insurance, which covers pre-existing

conditions, short–term insurance plans do not provide

pre-existing condition coverage. Short–term policies

only protect against unforeseen incidents, covering

basic medical needs and emergencies.

For family coverage, a short–term plan was $258 per

month in 2018, compared with $1,168 per month for

an ACA plan. Short–term plans will be even more attractive

now that people need to get a medical exam only once a

year to get approved instead of every three months.

Short-term insurance is not required to observe the ACA requirements.

Short-term plans do not cover all of the ten essential health benefits that ACA health plans are required to cover. Most short-term plans are designed to protect against sudden illnesses and injuries and provide only emergency services coverage.

Short-term insurance is flexible.

The coverage duration of short-term insurance plans ranges from 30 days to 12 months, so your length of coverage is up to you. Short-term policies are also often approved quickly, and can go into effect as soon as the day after applying.

Short-term insurance is less expensive.

Short-term policies can use medical underwriting to reject less healthy people or those with certain health conditions. As a result, this makes the cost of short-term plans much lower than regular insurance plans.

Short-term insurance is not renewable.

Once your short-term insurance coverage period ends, you cannot renew your existing policy. However, you may be able to enroll in a new short-term health insurance policy. You can usually enroll in up to two policies each year.

Short-term insurance does not provide pre-existing condition coverage.

Unlike traditional insurance, which covers pre-existing conditions, short-term insurance plans do not provide pre-existing condition coverage. Short-term policies only protect against unforeseen incidents, covering basic medical needs and emergencies. If you have a pre-existing medical condition, a short-term insurance plan may not provide you with the coverage you need.

Total Number Insured Under 65

HOW DOES FIXED INDEMNITY HEALTH INSURANCE WORKS?

What is Fixed Indemnity Insurance

With it You can choose any doctor or hospital you want. But if you use providers in the benefit plan network, you may save money with provider discounts. Coverage is available for individuals and families–and you can apply at any time. There’s no need to wait for an enrollment period. Benefits are paid regardless of your other coverage–and there are no deductibles to meet. Health ProtectorGuard–simple, straight-forward benefits for covered services.

we will assist you 24/7

Quick Contact

Make a beautiful website

It has never been easier to create pages and websites on WordPress