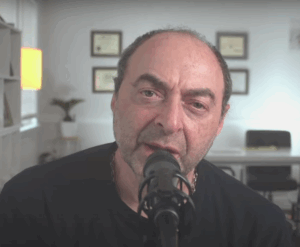

Building Trust Through Long-Term Relationships in Health Insurance: Segal’s Story

One of the best parts of my job is building long-term relationships with my clients. When you’ve been in the health insurance business as long as I have, you start seeing clients not just as customers, but as friends. That’s exactly the case with Segal.

Segal and I go way back, over ten years now, maybe even closer to twelve. I first met her through a mutual friend who recommended me for health insurance advice. Since then, she’s reached out to me every single year, and sometimes even in the middle of the year, with questions about coverage, policy changes, and all the little details that come with managing health insurance.

She once joked that instead of calling ChatGPT, she just calls me because I have all the answers when it comes to health insurance. And honestly, that’s what I strive for—to be the go-to person my clients trust when they need help.

Helping Busy People Save Time

Segal is a single mom and a business owner. She runs a successful house cleaning business and has been working with many of her clients for over 20 years. Between running her business and taking care of her son, she doesn’t have time to sit down and research health insurance options for hours.

That’s why when she calls, she needs quick, clear answers. I know how valuable time is for parents and entrepreneurs, so I make sure my clients get straight answers without all the complicated insurance jargon.

Trust and Reliability Matter

One thing I admire about Segal is how much she values relationships. She keeps a small, trusted client base in her cleaning business because she believes in reliability and trust. I operate the same way.

For over a decade, Segal has trusted me to guide her through the ever-changing world of health insurance. Whether it’s breaking down the differences between U.S. and European health insurance systems or helping her family members get the right coverage, she knows she can count on me.

She’s even referred her friends and family to me because she knows I’ll take care of them just like I take care of her. That kind of trust means everything to me.

Health insurance can be confusing, especially for people who are new to the U.S. system. Segal, who originally comes from Lithuania, told me that in Europe, health insurance is often bundled together, medical, vision, dental, all in one package. Here in the U.S., it works differently, and that can be frustrating for newcomers.

She appreciates that I don’t just give her a one-size-fits-all answer. Instead, I listen, understand where she’s coming from, and explain things in a way that makes sense.

If there’s one thing I’ve learned from my years in this business, it’s that good relationships make all the difference. People want someone they can trust, someone who picks up the phone, and someone who genuinely cares about their well-being.

Segal’s story is just one example of why I love what I do. I’m here to make health insurance easier, so my clients can focus on what really matters—taking care of their families and growing their businesses.

If you ever have questions about health insurance, just like Segal does, I’m always here to help.

Contact us here: https://ehealth20.com/contact/